How Interac Is Changing the Game for Canadian SMEs

Audience: Business Owners, LendersKeywords: Interac, SME payments, real-time payouts The New Reality of Business Payments Small and medium-sized enterprises (SMEs)…

Read moreAccept/Pay Global allows complete control of your B2B payments so you and your business can grow confidently.

Send and receive funds seamlessly with fast processing, security, and full transparency.

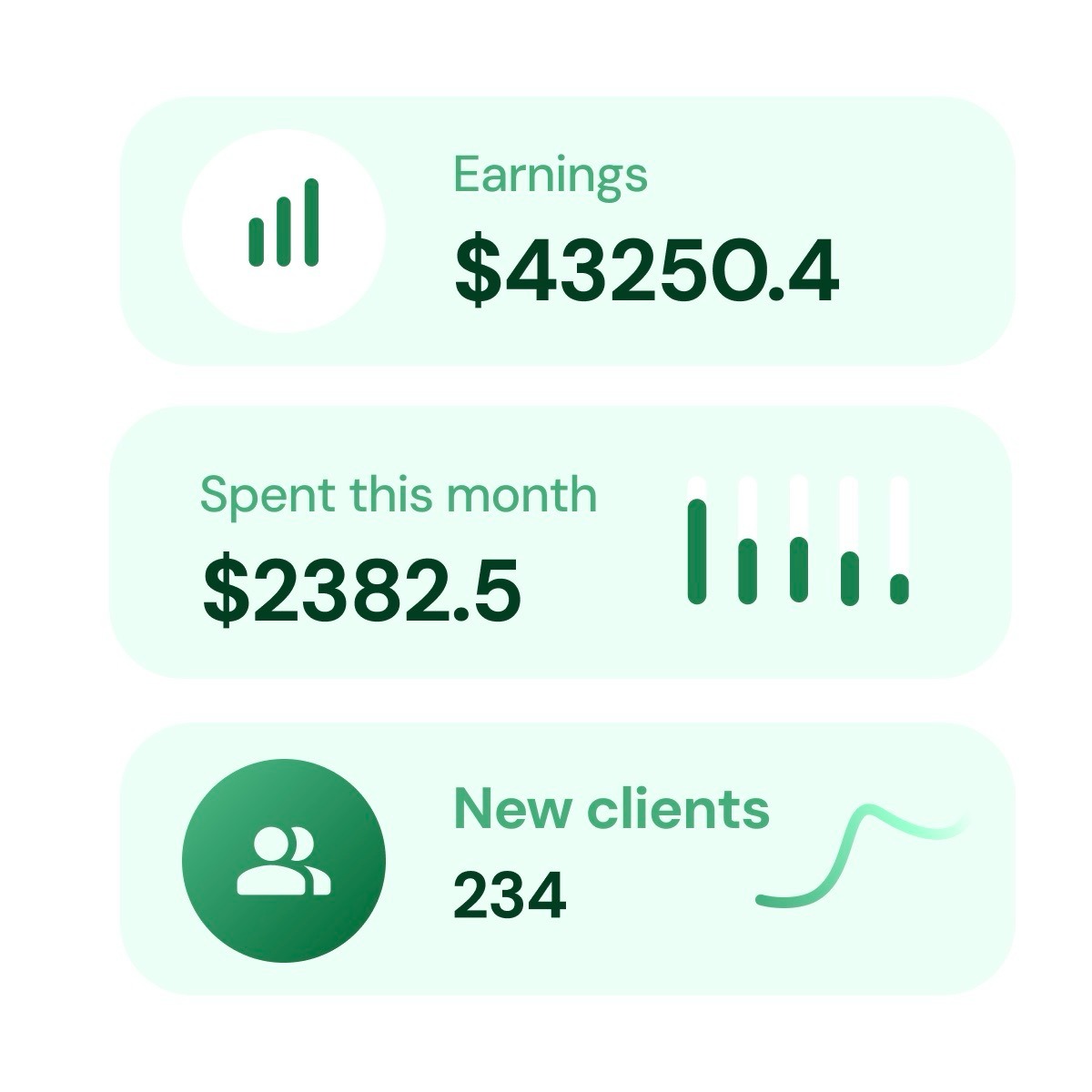

Scale beyond small businesses with automated bulk payments and industry-specific solutions.

Offer branded payment solutions with easy integration, security, and full customization.

Onboard merchants swiftly through our intuitive, cloud-based platform, no software installation or IT support required. Our user-friendly interface simplifies the onboarding process, making it straightforward for businesses of all sizes. You can also configure one-time or recurring billing schedules tailored to your needs, allowing for automated transactions.

Securely process EFT transactions and make unlimited payouts directly from our browser-based interface. With no software to install, you can manage payments from anywhere, streamlining your disbursement process. Our platform ensures efficient handling of payments to vendors, employees, or partners with ease and reliability.

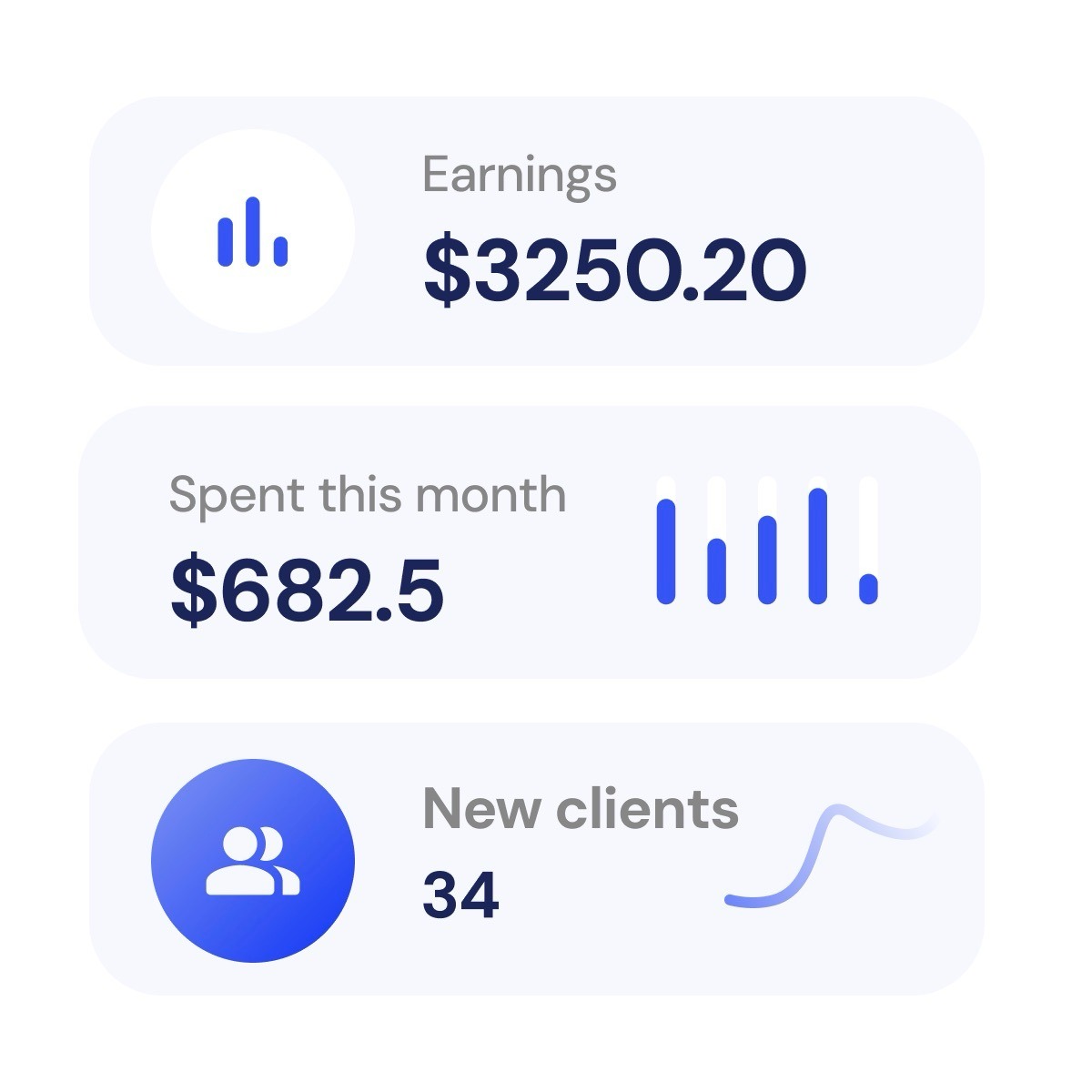

Access customizable, real-time reports 24/7 and receive automatic notifications about your transactions. Monitor your financial activities effortlessly, gaining the insights necessary to manage your business efficiently. Stay informed with instant updates on transaction statuses and account activities, all accessible anytime, anywhere.

Stay compliant with ever-changing regulations while our robust security measures protect against fraud. Our platform continuously adapts to the latest regulatory mandates and industry recommendations, ensuring your operations remain compliant. Benefit from stringent security protocols developed over decades of experience to minimize exposure to risk and unauthorized transactions.

Whether you’re a small business or a financial institution, our payment platform offers the security, flexibility, and support you need to succeed. Let us handle your payments while you handle your business.

Audience: Business Owners, LendersKeywords: Interac, SME payments, real-time payouts The New Reality of Business Payments Small and medium-sized enterprises (SMEs)…

Read more

The Lending Landscape Is Changing Canadian lending has entered a new era. Borrowers no longer judge lenders only on rates…

Read more

The Tuition Payment Challenge For education providers, collecting and managing tuition is more than an administrative task — it’s the…

Read moreWe’re here to make Electronic Fund Transfer (EFT) payments as simple and seamless as possible. Here are some of the most common questions asked by customers:

An EFT is the electronic movement of money from one bank account to another. It’s commonly used for payments, transfers, and bill payments without needing physical checks.

EFTs are processed through secure networks, transferring money from the payer’s bank to the recipient’s bank, typically by entering account details and confirming the transaction online.

While both are electronic, wire transfers are faster and often used for large sums but incur higher fees. EFTs include various forms like ACH payments, which are more cost-effective for recurring transactions.

ACH (Automated Clearing House) transfers are a type of EFT commonly used for direct deposits and recurring payments. They’re cost-effective but may take a few days to process.

EFTs typically take one to three (1-3) business days, though some payments, like wire transfers, may complete on the same day.

Yes, EFTs are generally safe due to encryption and authentication protocols, but it’s essential to verify the recipient and use trusted payment networks.

Cancellation depends on the type of EFT and the bank’s policies. ACH payments may be canceled before they’re processed, but instant transactions like wire transfers are usually final.

The common types of EFTs include direct deposits, ACH transfers, wire transfers, online bill payments, and debit card transactions.

EFT is a broad category covering any electronic movement of funds, while online payments specifically refer to digital transactions made through e-commerce sites or online banking.

Some EFTs, like ACH transfers, have low or no fees, while wire transfers usually have higher fees. Fees vary by bank and type of transfer.

You can initiate an EFT through online banking, mobile banking apps, or by setting up automatic payments with a business or employer.

Yes, but international EFTs, often called international wire transfers, may have additional fees and processing times due to currency exchanges and regulations

EFTs move funds directly between bank accounts, while credit card payments involve a line of credit from the card issuer, which must be repaid.

Most banks will impose daily limits on EFT transactions to prevent fraud, which can vary by bank and transaction type.

EFTs can fail due to insufficient funds, incorrect account details, bank limits, or network issues. Please contact us if this is the case.

Our team is here to provide the answers you need. Contact us today and let us help you make the most of Accept/Pay Global’s innovative EFT solutions.